Charge Into

Your Future

Discover

More

Announcements

Bands on Campus

Charge into a fun evening at the final 75th Anniversary Bands on Campus celebration, Wednesday, May 1, 5-8 p.m. There will be music, a car show, food trucks, and more. Everyone is invited.

What’s Happening at EWC

Upcoming Events

Healthy Aging Yoga

(Men’s Golf) District Tournament

Gentle Yoga

Explore

Eastern Wyoming College

The campus of Eastern Wyoming College is a beautiful and inviting place for students to learn and grow. Spread across 68 acres, the campus features modern, state-of-the-art facilities and green spaces that make it an excellent environment for academic and extracurricular activities.

Explore Our CampusStart Here

Find Your

Path at EWC

At EWC, we’ll help you discover your calling in life and provide you with opportunities for success.

Explore All ProgramsGet To Know Us

Meet the EWC Family

Leading the Way Since 1948

Eastern Wyoming College, established in 1948, is a two-year institution known for providing quality educational programs in the region. With our rich history and diverse educational opportunities, Eastern Wyoming College remains an essential institution for the community and beyond. As part of our enduring legacy, we charge the way ahead for a brighter future-for our students, staff, and community.

Our Story

Investing in Our Local Community

Our community is the heart of who we are and we love investing in it by offering educational opportunities for anyone in the area that is interested.

Community Education

From Our Students

EWC Stories

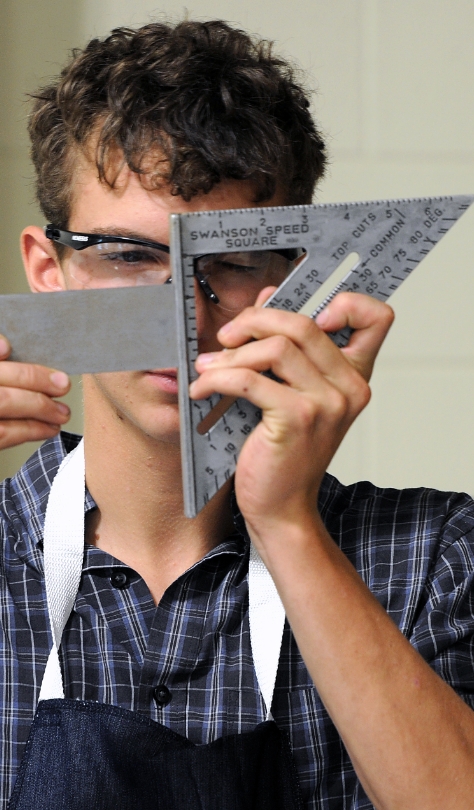

“I came to EWC from Cumberland, Wisconsin to study welding. I really like it here. It is a lot of fun and you learn a lot. The teachers are always willing to help.”

Inari Johnson